The Credit Suisse Research Institute recently released its second annual “CS Family 1000” report, based on a global database of almost 1000 family-owned businesses. The report’s findings reconfirm that family-owned companies have established a trend of outperforming their non-family-owned counterparts. This year’s report also offers insights into the performance of family-owned businesses across generations.

Tharawat Magazine has compiled a list of the most interesting facts and trends that emerged from the CS 1000 Family report.

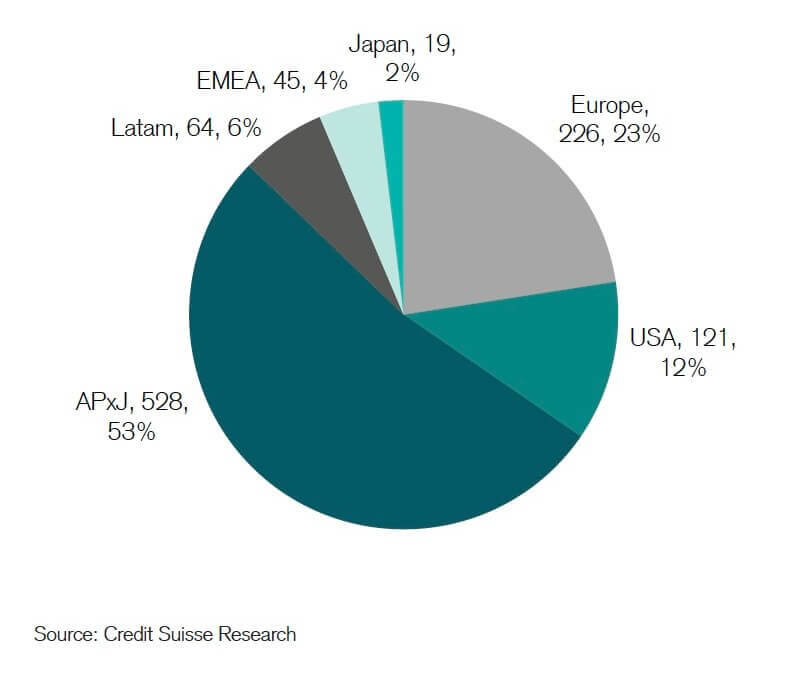

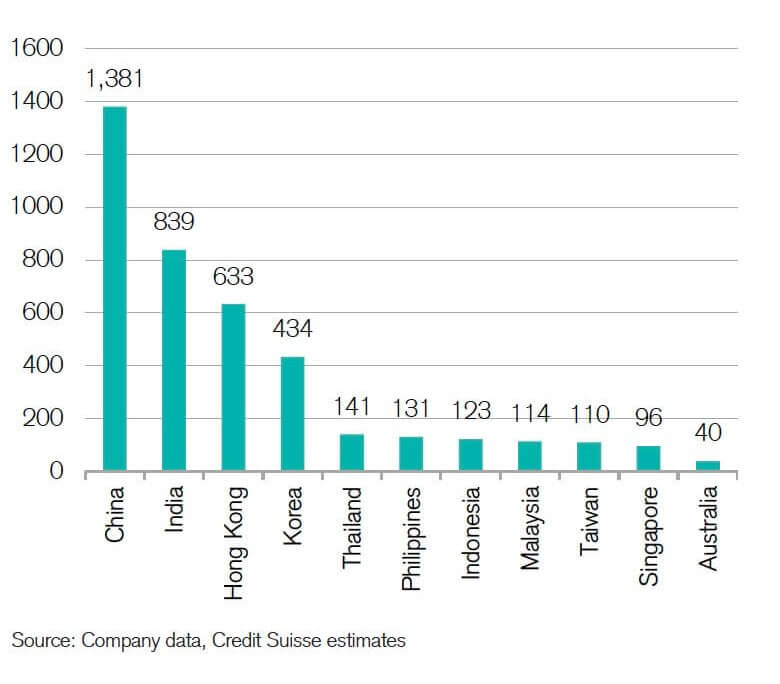

Asia’s Emergence

Credit Suisse’s data shows that the rapid growth in Asia also extends to family-run businesses. A little more than half of the world’s family-owned companies reside in non-Japan Asia and comprise the bulk of younger generation and founder companies.

Figure 1. Number of family-owned companies by region.

However, Indian and Chinese family-run businesses exceed the region’s majority in financial performance, with India home to half of the top 30 earners.

Figure 2. Total market capitalisation (USD bn).

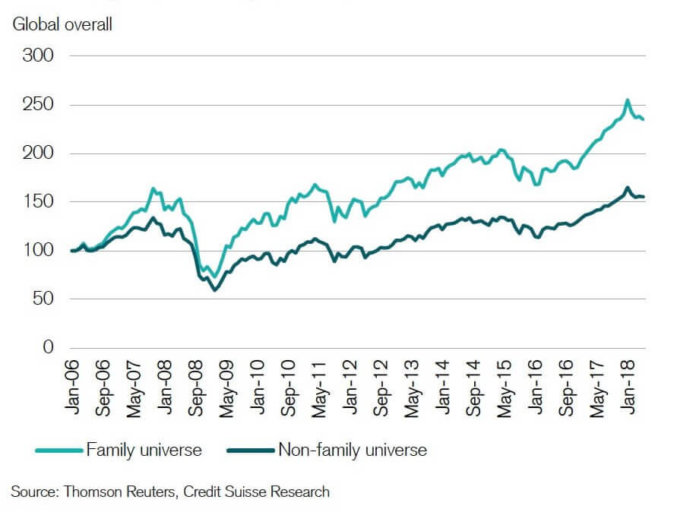

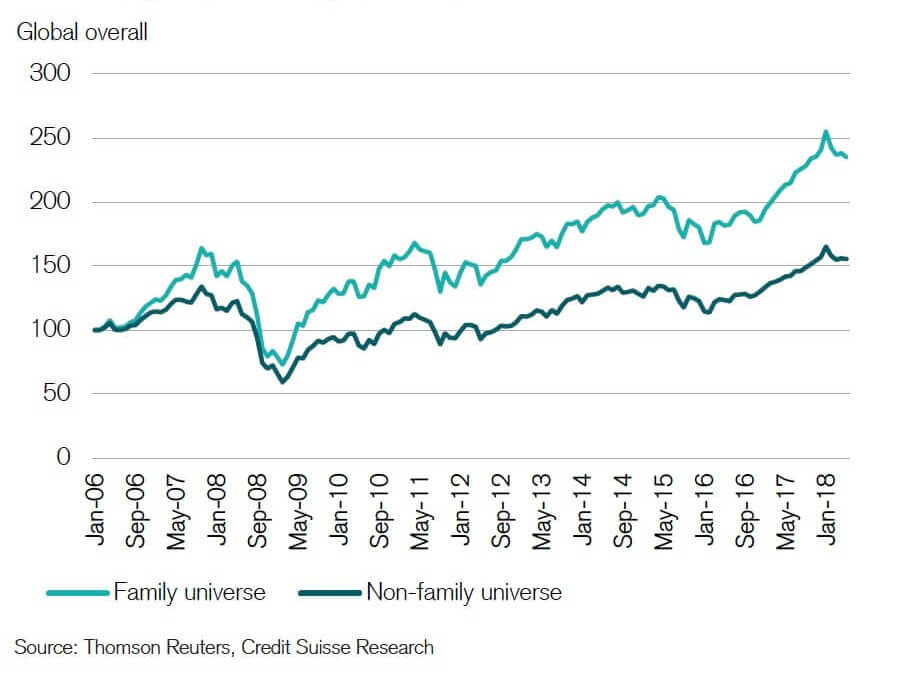

A Global Trend

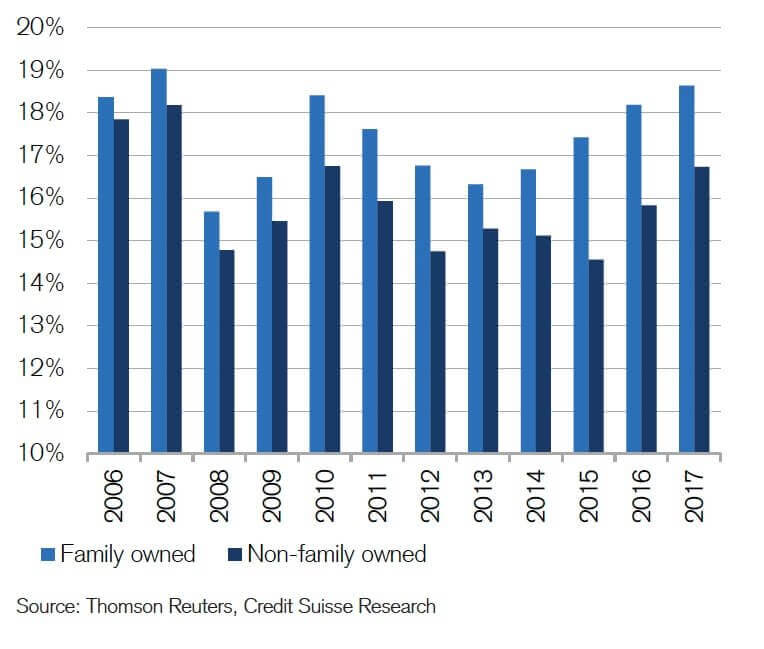

When looking at the range of businesses around the world, Credit Suisse’s data establishes a definite trend. Since 2006, family-owned companies have outperformed non-family owned companies in every country.

Figure 3. Family-owned companies have outperformed non-family-owned companies since 2006.

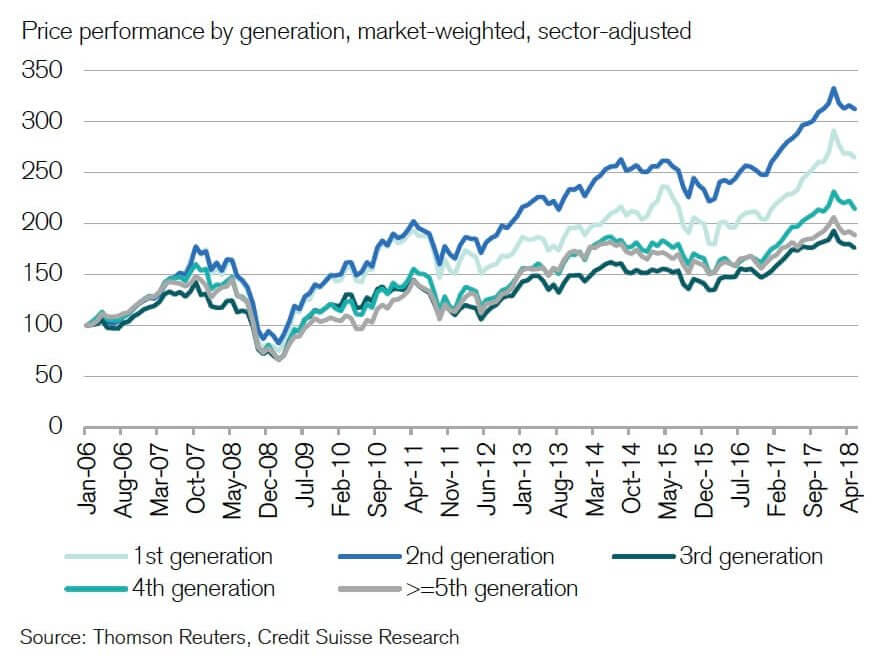

The data since 2006 also confirms that family-owned companies in their third to fifth generation of leadership have for the most part been surpassed in performance by younger companies in their first or second generation. Yet, both groups still outperform their non-family-owned counterparts.

Figure 4. Return profile for family-owned companies by age.

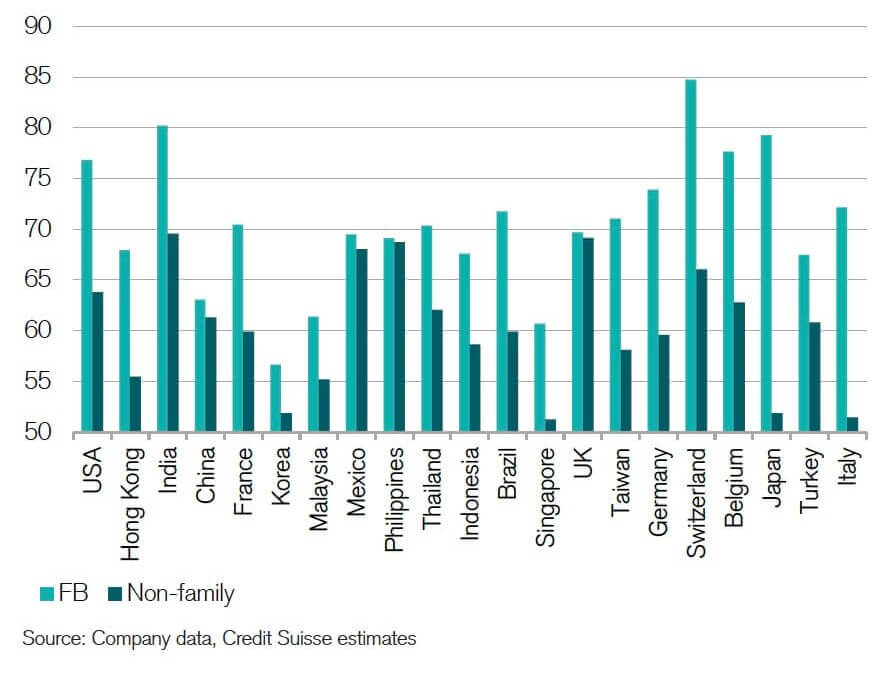

When it comes to quality, Credit Suisse’s research suggests that family-owned companies not only score ahead of non-family-owned companies by nation but also above the global average.

Figure 5. Quality score by country (50 = average, 100 = maximum).

The findings additionally show that from 2006 to 2017, family-owned companies have generated better margins than their non-family-owned peers across all nations.

Figure 6. Family-owned companies generate better margins than non-family-owned companies.

Underperforming North America

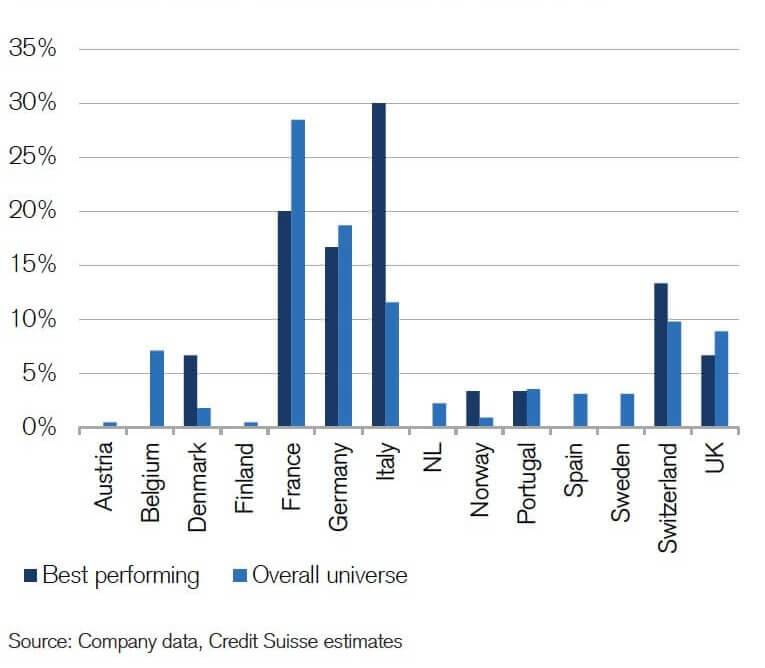

Interestingly, when looking at North America, the data shows that the top 25 family-owned companies fall behind their APAC counterparts in performance. While in Europe, the 30 top performing family-owned companies contribute to their nation’s financials and healthcare above the region’s average.

Figure 7. Best-performing European family-owned companies by country (relative to universe).

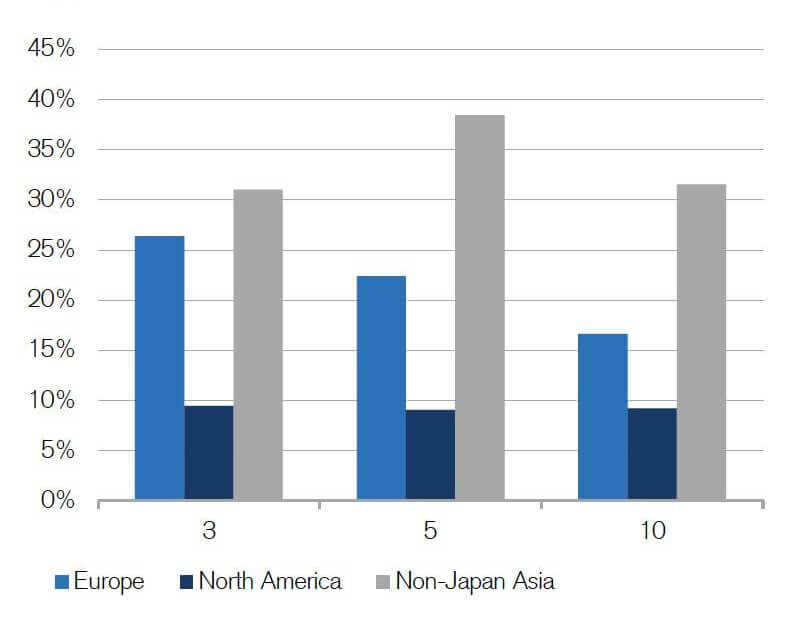

Figure 8. Annual average outperformance of the top 30 family-owned companies in Europe and non-Japan Asia and top 25 in North America vs respective regional sector indices.

Credit Suisse’s report establishes clear links between family-run companies and performance. Asia’s economic expansion continues to be a key factor in the proliferation and operational prowess of family businesses in that region. European family-owned companies remain strong and lead the region in several categories.

Despite North America’s lagging metrics, Credit Suisse’s findings suggest that the next generation of family business owners are overtaking their more established counterparts globally.